Sign-Up For GuruFundPicks’ Consensus Picks’ Based Newsletter Service

Identifying Top Picks Every Quarter Based on Top Fund Manager Consensus Picks’ And Our Proprietary Analysis

✱ Market-Beating Returns ✱ Top Newsletter Picks ✱ Auto-Trading ✱ Free Trial ✱ Money Back Guarantee

GuruFundPicks’ Small-Cap Newsletter Returned 96.5% Since Inception In Nov’12

Beating The Markets By ~5,400 basis pts… Here Is How We Can Help You…

Is the Newsletter Service Right For Me?

Whether you are a value or growth investor, our newsletters, based on collective or Consensus Picks’™ by over 330 of Wall St.’s top fund managers, hand picked by us, have the potential to super-charge your portfolio returns. You can use the Newsletters to cherry-pick ideas for you to explore further, as most do, or you can use them to automatically re-balance your portfolio every quarter via our partner, online broker DittoTrade®.

If Newsletters are not for you, you should review our Consensus Picks Tools, suitable for DIY investors and traders, and our AlphaNews Edge Trade Alerts Services, available for self & auto-trading.

What Is Your Consensus Picks’™ System?

Our Consensus Picks™ system is based on our latest intelligence of the buying & selling by 330+ of Wall St.'s top fund managers. Broadly speaking, it gives a way for the average investor to access not one, but a mastermind of Wall St.’s top fund managers, and buy what a multitude of them are buying in bulk and/or sell the ones that a large number of them are exiting in a hurry.

Our GuruRank® system then ranks each of over 6,300 stocks in terms of its relative attractiveness to these top fund managers, based on their latest buying & selling, and our GuruValue™ system assigns a dynamic valuation target to each stock, based on our proprietary algorithm that calculates what value Gurus would assign to each stock today, based on current conditions.

What Other Factors Go Into Picking Stocks?

The Consensus Picks’™ system is a starting point, albeit a critical one, to picking stocks for the Newsletter strategies. We pick from the top 5% ranked stocks, 20 small-cap and 5 large-cap stocks, based on a rigorous fundamental analysis, supplemented by insider trading data, and over a dozen other current & historical sector and stock-related analysis and indicators. Similarly, we pick top 5 short-sell picks from the bottom-ranked stocks. These are then packaged into the Top 20 Small-Cap and the Top 30 All-Cap Long/Short Strategies.

Do you focus on any one Sector or group?

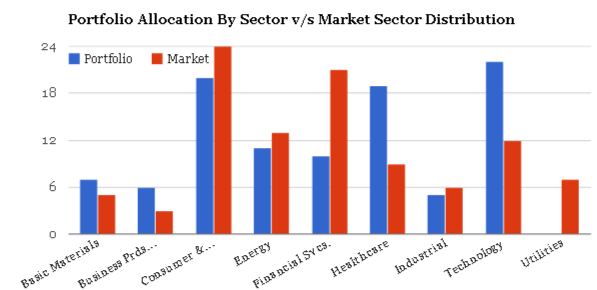

Newsletter picks are generally diversified across all sectors. In fact, as shown in the illustration below, outside of a slight over-concentration in tech & healthcare at the expense of financials & utilities, the sector distribution of the Newsletter strategy is similar to the market.

Which Newsletter Should I Choose?

The Top 20 Small-Cap Newsletter has out-performed both the Russell 2000 small-cap index and the Top 30 All-Cap L/S Newsletter by wide margins (see performance #’s in right column). So, based on returns, the Top 20 would be your best bet. There are other reasons, however, why you might choose the Top 30, including portfolio diversification and downside protection. Also, we will note that the relative under-performance of the Top 30 is mainly on account of losses on short sells, due to the strong market rally, as the large-cap picks in the Top 30 actually had comparable returns to the Top 20 small-caps.

We would like you to experience the full breadth of Newsletter picks from the Consensus Picks’™ system, so as to judge it fairly. Hence, as an incentive, we are offering complimentary a channel of your choice (a $120 value) if you subscribe to the Top 30 newsletter (please see the DIY Tools offering for what’s included).

What do I get with Newsletter Membership?

Members get access to Current Qtr. Edition of Newsletter, including:

1Top 20 Small-Cap Picks / Top 30 All-Cap L/S Picks.

2Two-page Analysis on each stock (view samples), including its GuruRank®, GuruValue™, key fundamentals & peer comparison, investment thesis, and top institutional buyers, sellers & holders.

3Additional 2-3 peer picks per pick, or 50-70 more picks.

4Access to Prior Quarter Newsletters

5Complimentary: Optional automated portfolio re-balance every quarter, available via our partner, online broker DittoTrade®.

What Other Benefits Are Offered to Members?

Newsletter members have access to following info on All-Stock-Data-At-A-Glance page for all 6,700+ stocks owned by top funds:

6Top Buyers, Sellers & Holders.

7Archive of All 13D/G Filings for Two+ Years

8Current fundamentals vs. closest peer group.

9Latest Chart

10Latest News

Additional benefits of Newsletter memberships include:

11Access to latest SEC 13-F’s by 330+ top funds (view sample).

12Access to latest SEC 13-D/G’s by 330+ top funds (view sample).

13Advance early access to our ‘Top Ideas’ & other articles.

14Periodic e-mails outlining value opportunities.

When Are Newsletters Published?

Quarterly. The Top 20 & Top 30 Newsletters are based on our Consensus Picks’™ system that goes through a major refresh every quarter after the SEC deadline for institutional quarterly 13-F filings (on 2/17,5/15,8/14 & 11/14 in 2015). Newsletters are typically published within 3-5 days after the refresh of our Consensus Picks’ system.

What Holding Period Do You Recommend?

The performance results in the right column assume a portfolio re-balance every quarter, flushing out prior quarter picks and replacing them with the most recent quarter picks. Depending on portfolio size and based on personal preference, you can easily modify that to your requirements, for example, by keeping the latest two or three quarters picks in the portfolio. Our research indicates comparable results up to four quarters, with the exception that our large-cap picks performed significantly better with longer holding periods.

How do I Subscribe? What Are the Rates?

You can subscribe with your credit or debit card using the form below, and picking the right plan and subscription period. Users of PayPal can purchase their subscription by clicking on the appropriate buttons at the bottom of the page.

The subscription rates are as follows:

✱ Top 20 Small-Cap Newsletter – $79/qtr.|$239/year (=$20/mos.)

✱ Top 30 All-Cap L/S Newsletter-$99/qtr.|$299/year(=$25/mos.)

✱ Top 30 Newsletter + Premium Membership (see here for details – $139/qtr.|$399/year (=~$33/mos.)

Newsletter Summary Results (Nov 2012 – Apr 2025)

Top 20 Small-cap Picks

✱ Portfolio Return: 96.5%

✱ Russell 2000 Small-Cap Index Return: 42.5%

✱ Average Win Ratio: 58.6%

✱ Average Gain Per Winning Trade: 24.2%

✱ Average Loss Per Losing Trade: (19.3)%

✱ No. of Qtrs. It Beat Market Index: 8 out of 12

Top 30 All-cap Long/Short Picks

✱ Portfolio Return: 61.0%

✱ Credit Suisse L/S Index Return: 18.9%

✱ Average Win Ratio: 57.1%

✱ Average Gain Per Winning Trade: 20.4%

✱ Average Loss Per Losing Trade: (17.5)%

✱ No. of Qtrs. It Beat Market Index: 8 out of 12

Top Winners From Newsletter Service

Neophotonics (NPTN) and MaxLinear (MXL) are the big winners from the current Q2/2015 Picks, up ~42% & ~68% resp. from their re-balance purchase. A sample of our other top winners from prior quarters is detailed below (the percent change is during one quarter up to next re-balance):

Basic Material & Energy Sectors

✱ Green Brick Partners (GRBK)– Q4/2014 Pick- up 32% to $10.31.

✱ US Silica (SLCA)– Q2/2013 Pick- up 52% to $35.24.

✱ Sibanye Gold (SBGL)– Q3/2012 Pick- up 32% to $3.85.

✱ Tesoro Logistics (TLLP)– Q4/2012 Pick- up 40% to $67.03.

✱ SemGroup Corp. (SEMG)– Q3/2012 Pick- up 25% to $69.27.

Consumer & Retail Sectors

✱ GoPro (GPRO)– Q4/2014 Pick- up 33% to $53.21.

✱ Orbitz Worldwide (OWW)– Q3/2014 Pick- up 54% to $11.69.

✱ Quiksilver Inc. (ZQK)– Q3/2012 Pick- up 55% to $5.96.

✱ Accuride Corp. (ACW)– Q3/2012 Pick- up 50% to $4.12.

✱ Vipshop Hldgs. (VIPS)– Q4/2013 Pick- up 35% to $17.74.

✱ Silicon Broadcast (SBGI)– Q2/2013 Pick- up 30% to $26.18.

Healthcare Sector

✱ Synergy Pharmaceuticals (SGYP)– Q1/2015 Pick- up 48% to $7.24.

✱ La Jolla Pharmaceutical (LJPC)– Q3/2014 Pick- up 112% to $23.27.

✱ Horizon Pharma (HZNP)– Q3/2014 Pick- up 80% to $21.91.

✱ Rockwell Medical (RMTI)– Q2/2013 Pick- up 149% to $14.25.

✱ Idera Pharm. (IDRA)– Q3/2013 Pick- up 133% to $5.79.

✱ Aegerion Pharm. (AEGR)– Q4/2012 Pick- up 105% to $60.09.

✱ Biolase Inc. (BIOL)– Q3/2013 Pick- up 73% to $3.07.

✱ Puma Biotech (PBYI)– Q3/2014 Pick- up 57% to $38.41.

✱ Cempra Inc. (CEMP)– Q2/2013 Pick- up 54% to $12.93.

✱ Novavax Inc. (NVAX)– Q3/2013 Pick- up 51% to $6.40.

✱ Acelrx Pharm. (ACRX)– Q4/2012 Pick- up 48% to $7.86.

✱ Vanda Pharm. (VNDA)– Q3/2013 Pick- up 47% to $15.13.

✱ Myriad Genetics (MYGN)– Q3/2013 Pick- up 42% to $36.21.

Technology Sector

✱ Smith Micro software (SMSI)– Q3/2014 Pick- up 47% to $1.44.

✱ FireEye (FEYE)– Q3/2014 Pick- up 41% to $42.83.

✱ Yelp Inc. (YELP)– Q1/2013 Pick- up 77% to $51.83.

✱ Micron Tech (MU)– Q2/2013 Pick- up 61% to $22.31.

✱ Twitter Inc. (TWTR)– Q1/2014 Pick- up 56% to $52.11.

✱ Angies List (ANGI)– Q3/2012 Pick- up 55% to $16.63.

✱ Xcerra Corp. (XCRA)– Q2/2013 Pick- up 44% to $7.19.

✱ Blucora List (BCOR)– Q2/2013 Pick- up 42% to $28.59.

All Other Sectors, incl. Business Prds./Svcs. and Industrial Sectors

✱ Stantec Inc. (STN)– Q4/2012 Pick- up 112% to $42.57.

✱ The ExOne Co. (XONE)– Q1/2013 Pick- up 51% to $67.80.

Even More Winners From Supplementary Picks

Besides the Top 20/30 Picks winners listed above, the following are additional picks that were identified in the Newsletters as one of the 2-3 peer stocks being accumulated per Newsletter Pick (the percent change is during one quarter up to next re-balance):

Basic Material & Energy Sectors

✱ Goodrich Petrol. (GDP)– Q4/2013 Pick- up 107% to $28.19.

✱ McEwen Mining (MUX)– Q3/2013 Pick- up 65% to $2.91.

✱ AngloGold Ashanti (AU)– Q3/2013 Pick- up 46% to $17.53.

✱ Carbo Ceramic (CRR)– Q2/2013 Pick- up 42% to $121.09.

✱ Hi-Crush Part. (HCLP)– Q2/2013 Pick- up 40% to $32.53.

✱ Emerge Energy (EMES)– Q2/2013 Pick- up 40% to $35.72.

Consumer & Retail Sectors

✱ Zale Corp. (ZLC)– Q3/2013 Pick- up 69% to $21.73.

✱ Nexstar Broadcast (NXST)– Q2/2013 Pick- up 39% to $49.39.

Financial Services Sector

✱ Fed. National (FNHC)– Q4/2013 Pick- up 46% to $23.09.

Healthcare Sector

✱ Idenix Pharm. (IDIX)– Q1/2014 Pick- up 239% to $24.50.

✱ Agios Pharm. (AGIO)– Q2/2014 Pick- up 150% to $110.56.

✱ Receptos Inc. (RCPT)– Q2/2014 Pick- up 112% to $126.23.

✱ OvaScience Inc. (OVAS)– Q1/2014 Pick- up 101% to $14.98.

✱ Halozyme Ther. (HALO)– Q2/2013 Pick- up 93% to $14.46.

✱ Agios Pharm. (AGIO)– Q3/2013 Pick- up 66% to $31.26.

✱ TG Therapeutics (TGTX)– Q3/2013 Pick- up 59% to $6.60.

✱ Uroplasty Inc. (UPI)– Q3/2013 Pick- up 48% to $4.12.

✱ IGI Labs. (IG)– Q2/2014 Pick- up 42% to $10.55.

Technology Sector

✱ Marketo Inc. (MKTO)– Q1/2014 Pick- up 41% to $33.73.

✱ Zynga Inc. (ZNGA)– Q2/2013 Pick- up 38% to $3.99.

Our Credentials

Our founder & CEO, Manish Babla has more than two decades of experience investing. During the past 10+ years, he has been managing full-time his family partnership fund Ganaxi Capital, during which he has out-performed the markets using Consensus Picks’ & other proprietary methodologies, including generating a 2,600% return in 3 years.

Mr. Babla holds a M.S.(Engg.), and MBA from University of Virginia Darden School of Business. He has 10+ years consulting experience, including advising Fortune 500 Sr. Execs while working at Management Consultant A.T. Kearney. For more info, view his LinkedIn Profile.

Assisting him and Ms. Sheth, a graduate of the NYU Stern School of Business, is a team handling website design, marketing, data analysis & customer support to serve the thousands of subscribers that use our services.

GuruFundPicks is also a top author on leading financial blog Seeking Alpha, writing over 900 premium & ‘Top Ideas’ articles since early 2011. Our articles have also been featured on Motley Fool, CNBC, Yahoo! Finance, Google Finance, and other portals.

Do You Offer A Free Trial?

You may try us risk-free. All GuruFundPicks.com subscriptions come with a 7-day free trial and a 30-day no-questions-asked 100% money-back guarantee. Transactions are processed at the end of your 7-day free trial period, so if you cancel before that time, there will be no charges. Beyond that, if you cancel within 30-days, you will receive a full refund, no-questions-asked.

Pay via credit or debit card…

– Select this for Top 20 Small-Cap Strategy Newsletter for $59/Qtr.

– Select this for Top 20 Small-Cap Strategy Newsletter for $179/Year

– Select this for Top 30 All-Cap Long-Short Strategy Newsletter for $79/Qtr.

– Select this for Top 30 All-Cap Long-Short Strategy Newsletter for $239/year.

– Top 30 Picks Newsletter + Premium Membership at $139/Qtr.

– Top 30 Picks Newsletter + Premium Membership at $399/year.

What Our Subscribers Are Saying About Us

WOW! A hell of report. If I compare to others, you are by far many steps ahead with your visual presentation and analyzing… KUDOS

I have copied Icahn, Klarman and other experts for a while, with limited success. Your Consensus Picks just make a lot more sense to me, and the results so far have been good.

The time, patience and attention you gave in answering all of my questions, including many obvious ones, is rare to find. I wish you success!

I buy only large-caps, so your service was not for me… You do the cancellation very well, prompt, honest.